Across the board, composite products are experiencing growing demand and are becoming a staple of the global manufacturing economy.

A preferred form of manufacture for thousands of profiles is a technique called pultrusion, targeted for key application markets such as utilities, auto, infrastructure and telecommunications.

Pultruded products are projected to be one of the most promising segments of the composites industry over the next decade. Although the market dipped in 2020 because of the global lockdown due to COVID-19, the global pultrusion market is showing signs of recovery in 2021.

Analysis from Lucintel projects that the market is expected to reach an estimated $3.3 billion by 2026 with a CAGR of 3% to 5% from 2021 to 2026. The major growth drivers for this market are increasing demand for lightweight, corrosion-resistant, and durable products for various end-use industries.

Common Applications

Some of the most common applications for pultruded products include products created to support:

- Construction, for items such as residential and commercial window, door, and frame profiles and reinforcements; pipe and electrical supports; and roll-up door panels

- Infrastructure, for items such as bridge components; corrosion-resistant guardrails; antenna housing; railway crossing arms; and highway sound barriers.

- Utilities, for items such as utility poles, cross arms, and line markers; electrical lines and trunking; wastewater and water treatment components; non-conductive ladder rails; and fiber optic cabling

Other uses for pultruded products span dozens of verticals, and include:

- Decks, barns and fences

- Perimeter fencing

- Tool handles

- Armor plates

- Demisting blades

- Cable trays

- Cored tubing

- Struts

- Hand and guard rails

Pultrusion is also preferred for industries that depend heavily on specific manufactured parts that are strong and lightweight. Such vertical sectors include auto, railway, and aerospace manufacturing. Other sectors include building, construction, electrical, chemical, and civil engineering.

Education is Key

In March 2019, the World Pultrusion Conference highlighted the attractive long-term prospects for pultruded products. The event was organized in Vienna by the European Pultrusion Technology Association (EPTA).

A record number of composites professionals from around the world discussed growth drivers for the pultrusion industry, dove deep into protrusions potential for existing and emerging applications, and explored the latest developments in materials, testing and standardization for pultrusion manufacturing.

Dr. Elmar Witten, Secretary of European Pultrusion Technology Association (EPTA) stated, “While some leading companies use pultrusion to stay competitive and deliver exceptional, innovative products and services to end-users, there are many original equipment manufacturers (OEMs), suppliers, manufacturers and engineers that are not using pultrusion. The North American Pultrusion Conference meets an important need to educate and inform the industry about pultrusion.”

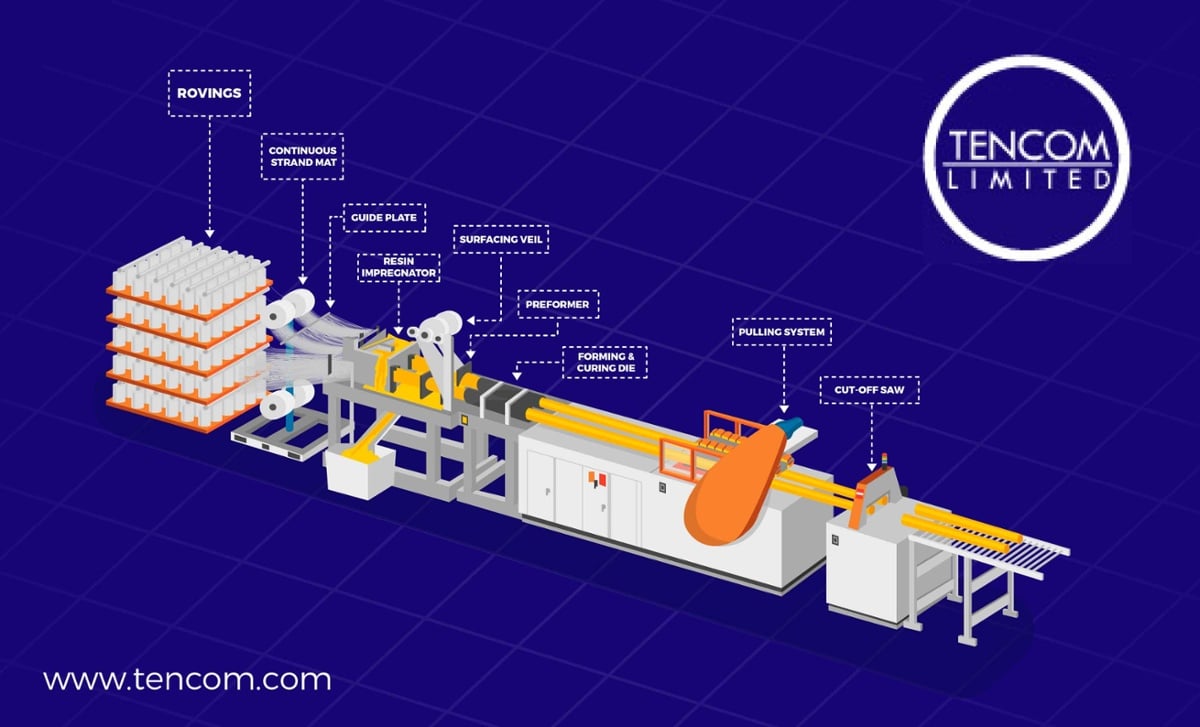

The pultrusion process ensures the rapid, cost-effective, high-volume continuous manufacture of structural profiles and components that are strong, durable, long-lasting, and lightweight.

Pultruded products are easy and inexpensive to transport, encourage forward-thinking for simplified assembly of consumer- or industry-facing solutions, and mesh perfectly with global sustainability goals.

Growth Drivers for Pultrusion

The infrastructure sector is predicted to be one major growth driver for pultruded composites, serving as a possible replacement for traditional steel rebar in the face of shrinking supply, higher purchasing costs and rising tariffs.

Steel rebar corrosion is responsible for massive asset management costs, requiring millions of dollars to be spent over a structure’s lifespan to remedy issues with reinforced concrete infrastructure. For example, in the US, over 54,000 out of 615,000 bridges are considered structurally deficient.

The steel rebar is a $200 billion global market. Detailed research has shown that glass fiber reinforced plastic (GRP) rebar has the potential to maintain its microstructural integrity and mechanical properties for longer than 15 years. For infrastructure owners, this can provide significant improvements in durability, reductions in life cycle cost reduction and enhanced long-term performance.

There are many other sectors, industries, and verticals capable of benefiting from the advantages of pultruded products.

- In the oil industry, corrosion-prone steel sucker rods can be replaced with lightweight pultruded carbon fiber composites for lower installation, maintenance, and energy costs.

- For 5G infrastructure and building elements, pultruded glass fiber laminates can deliver installation and durability benefits while minimizing attenuation of the shorter wavelength 5G signals.

- Spar cap structures for longer, more slender wind turbine blades can be improved with pultruded composites to increase turbine efficiency.

By and large, standardization initiatives in the US and Europe will play a large part in determining which pultruded composites will be easily, quickly, and efficiently adopted across growing markets.

Technologies that can assist in non-destructive testing, as well as new advances in resin systems and curing agents that can safely increase pultrusion line speed without compromising the final product, will also play a part as pultrusion products gain more of the market share across all verticals.

Over the next five years, the industrial demand for pultruded products is anticipated to be the dominating segment. High-strength structural composites are crucial for the success and cost-effectiveness of offshore oil drilling projects, cooling towers, and civil engineering projects, all of which will drive demand for pultruded composites.

Pultruded products deliver high-level corrosion and heat resistance, significant strength-to-weight ratios, dielectric properties, and dimensional stability ─ all of which can benefit designers on construction projects.

The Takeaway

The pultrusion manufacturing process can produce nearly any constant cross-sectional shape in almost any size, allowing penetration of a vast range of market areas. Certain markets derive benefits from pultruded products above and beyond price competitiveness, thanks to distinct advantages which traditional competitive materials cannot supply.

- Corrosion resistance: Construction verticals can benefit from fiberglass pultruded products that resist both acidic and alkaline corrosives, making them ideal for use in outdoor or harsh environments.

- Electromagnetic transparency: Telecoms and wireless companies can benefit from fiberglass protrusion's ability to be readily penetrated by radio waves for support of two-way radios, cell phones, WiFi or Bluetooth connections.

- Electrical insulation: Safety is increased in charged environments with nonconductive pultruded fiberglass-handled tools and fiberglass pultrusion ladders providing insulation from electrical shock.

- Thermal insulation: The lowered thermal transmittance provided by fiberglass pultrusion reduce condensation and support feature installations that require the retention of thermal properties through a wall cavity or on a surface.

Tencom can help you customize FRP components and integrate them into the manufacturing process.

Contact Tencom if you want to discuss pultruded profiles for your projects.